Pipedrive CRM Setup for Insurance Lead Generation: A Comprehensive Guide

Pipedrive CRM setup for insurance lead generation lays the foundation for an intriguing exploration, offering readers a detailed narrative with a blend of formal language and originality right from the start.

The following paragraphs will delve into the specifics of setting up Pipedrive CRM for insurance lead generation, providing valuable insights and practical tips for enhancing lead management efficiency.

Overview of Pipedrive CRM Setup for Insurance Lead Generation

Using a Customer Relationship Management (CRM) system is crucial for insurance lead generation as it helps insurance agents and companies effectively manage and nurture leads, resulting in higher conversion rates and improved customer relationships. Pipedrive, a popular CRM platform, offers specific features tailored to the insurance industry, making it an ideal choice for lead management.

Benefits of Utilizing Pipedrive for Insurance Lead Generation

- Efficient lead tracking and management: Pipedrive enables users to easily track and organize insurance leads, ensuring that no potential opportunities slip through the cracks.

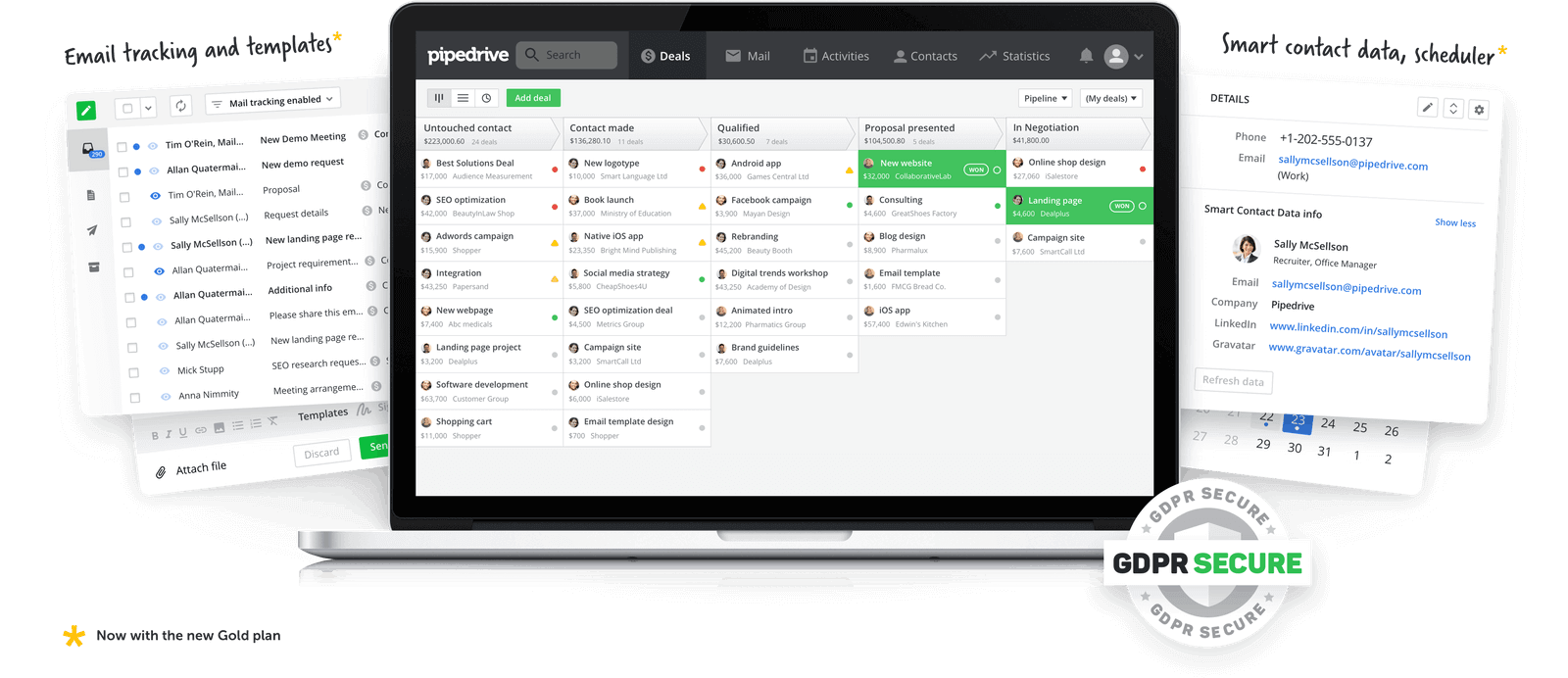

- Automated workflows: The platform allows for the automation of repetitive tasks, such as follow-ups and reminders, saving time and ensuring timely communication with leads.

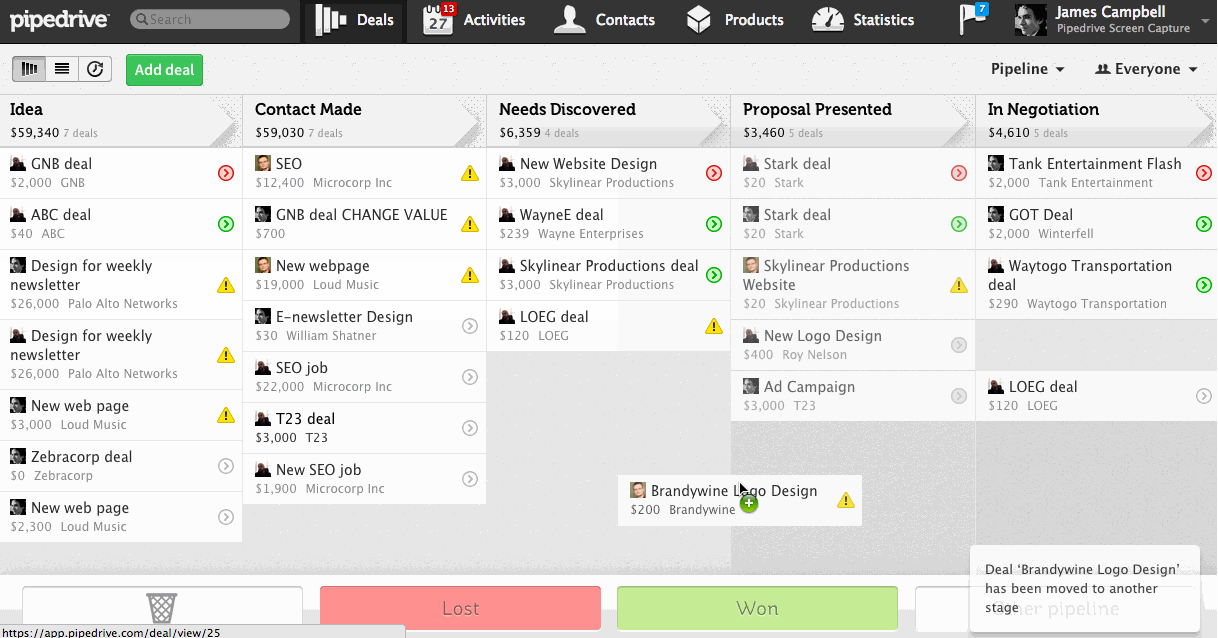

- Customizable pipelines: Pipedrive allows users to create customized pipelines to match the specific lead generation process of the insurance industry, optimizing efficiency and effectiveness.

Key Features of Pipedrive CRM for Managing Insurance Leads

- Lead scoring: Pipedrive offers lead scoring capabilities, allowing users to prioritize leads based on their likelihood of conversion, thereby focusing efforts on high-quality prospects.

- Email integration: The CRM seamlessly integrates with email platforms, enabling users to send personalized communications and track interactions with leads directly within the system.

- Reporting and analytics: Pipedrive provides insightful reports and analytics on lead generation activities, helping users identify trends, optimize strategies, and make data-driven decisions.

Example Scenario of How Pipedrive Streamlines Insurance Lead Generation

In an insurance agency, Pipedrive can streamline the lead generation process by automatically assigning new leads to agents based on predefined criteria, setting follow-up tasks, and sending personalized emails at key touchpoints. This automation ensures that leads are efficiently nurtured, increasing the chances of conversion and improving overall productivity within the agency.

Setting Up Pipedrive for Insurance Lead Generation

To effectively set up Pipedrive for insurance lead generation, you need to follow a series of steps that will help you customize the platform to meet the specific needs of your insurance sales process.

Creating an Account on Pipedrive

- Visit the Pipedrive website and sign up for an account using your email address.

- Follow the prompts to set up your account details, including company name, industry, and contact information.

- Choose a subscription plan that best suits your insurance lead generation requirements.

Customizing Pipelines and Stages

- Access the settings in Pipedrive and navigate to the Pipelines section.

- Create a new pipeline specifically for insurance leads and define the stages of your sales process, such as "Prospect," "Quote Sent," "Follow-up," etc.

- Customize each stage with relevant details and actions to ensure smooth progression of leads through the pipeline.

Importing Existing Leads and Contacts

- Export your existing leads and contacts data into a CSV file from your current CRM or database.

- In Pipedrive, go to the Import section and upload the CSV file to import all your leads and contacts into the system.

- Review and update any missing or incorrect information to ensure data accuracy.

Integrating with Other Tools

- Explore the Pipedrive Marketplace for integrations with popular tools used in the insurance industry, such as MailChimp for email marketing or Zapier for automation.

- Select the desired integrations and follow the instructions to connect them with Pipedrive for seamless lead management.

- Regularly check for new integrations that can enhance your lead generation and sales processes.

Optimizing Pipedrive for Effective Lead Tracking

Tracking leads effectively is crucial for insurance lead generation success. In Pipedrive CRM, you can streamline this process to maximize your results.

Tracking Communication with Leads

Within Pipedrive, you can easily track all communication with leads by logging emails, calls, and meetings. This allows you to have a complete overview of your interactions and tailor your approach accordingly.

Setting Up Lead Scoring Criteria

It is essential to set up lead scoring criteria in Pipedrive to prioritize high-quality leads. By assigning scores based on lead behavior, demographics, and engagement, you can focus on leads that are more likely to convert.

Automating Tasks and Reminders

To stay on top of lead follow-ups, leverage Pipedrive's automation features to schedule tasks and set reminders. This ensures that no lead falls through the cracks and helps you maintain a consistent follow-up strategy.

Generating Reports and Analytics

Pipedrive offers robust reporting and analytics capabilities that allow you to measure the effectiveness of your lead generation efforts. By analyzing key metrics such as conversion rates, lead source performance, and pipeline velocity, you can make data-driven decisions to optimize your lead generation strategy.

Ensuring Data Security and Compliance in Pipedrive for Insurance Lead Generation

Data security and compliance are crucial in the insurance industry due to the sensitive nature of the information handled. It is essential to protect lead data from unauthorized access and ensure compliance with data protection regulations.

Security Features in Pipedrive

- Pipedrive offers SSL encryption to secure data transmission between the user's device and Pipedrive servers.

- Two-factor authentication adds an extra layer of security by requiring users to verify their identity with a code sent to their mobile device.

- IP Whitelisting allows businesses to restrict access to Pipedrive based on specific IP addresses, enhancing security.

Tips for Compliance in Pipedrive

- Regularly update Pipedrive to ensure you are using the latest security patches and features.

- Review and understand the data protection regulations relevant to your industry to ensure compliance in lead management.

- Implement strong password policies and encourage users to create unique and secure passwords for their accounts.

Setting Up User Permissions and Access Controls

- Assign roles with specific permissions in Pipedrive to control who can view, edit, or delete lead information.

- Restrict access to sensitive data by setting up custom user roles and defining access levels based on job responsibilities.

- Regularly review and update user permissions to ensure that only authorized personnel have access to confidential lead data.

Ending Remarks

In conclusion, optimizing Pipedrive CRM for insurance lead generation can revolutionize the way insurance agents manage their leads, leading to increased productivity and more effective tracking of potential clients.

Key Questions Answered

How can Pipedrive CRM benefit insurance lead generation efforts?

Pipedrive CRM offers robust features tailored for managing insurance leads efficiently, such as customizable pipelines and lead scoring criteria.

Is it easy to integrate Pipedrive with other tools commonly used in the insurance industry?

Yes, Pipedrive offers seamless integration with various tools to streamline lead management processes and enhance overall efficiency.

What security measures does Pipedrive offer to protect sensitive lead information?

Pipedrive provides advanced security features to safeguard lead data, including encryption protocols and user permission controls.