Pipedrive Automation Tools for Financial Advisors: Enhancing Efficiency and Productivity

Exploring the realm of pipedrive automation tools for financial advisors unveils a world of possibilities aimed at revolutionizing how financial tasks are managed. From streamlining workflows to optimizing productivity, these tools offer a strategic advantage in the competitive landscape of financial advisory services.

As we delve deeper into the features, implementation strategies, customization options, and more, the potential for leveraging Pipedrive automation becomes increasingly evident.

Pipedrive Automation Tools for Financial Advisors

Automation tools play a crucial role in helping financial advisors streamline their workflow, increase efficiency, and ultimately improve client satisfaction. Pipedrive, in particular, offers a range of automation features that can significantly benefit financial advisors in managing their daily tasks and client interactions.

Tasks that can be automated using Pipedrive

- Lead Management: Pipedrive can automate lead capture, qualification, and nurturing, ensuring that financial advisors can focus on high-priority leads.

- Follow-Up Reminders: By setting up automated follow-up reminders, advisors can stay on top of client communications and never miss an important meeting or deadline.

- Email Campaigns: Pipedrive allows for the automation of email campaigns, making it easier to engage with clients and prospects at scale.

- Sales Pipeline Management: Automating the sales pipeline in Pipedrive can help advisors track the progress of deals, identify bottlenecks, and make data-driven decisions.

Streamlining Workflows with Pipedrive

By leveraging automation tools like Pipedrive, financial advisors can streamline their workflows in several ways:

- Increased Efficiency: Automation reduces manual tasks, saving advisors time and allowing them to focus on more strategic activities.

- Improved Accuracy: Automated processes minimize the risk of human error, ensuring that data and client information are always up to date and accurate.

- Enhanced Client Experience: With automation, advisors can provide timely and personalized interactions, enhancing the overall client experience and building stronger relationships.

Features of Pipedrive Automation Tools

Pipedrive offers a range of features specifically designed to enhance productivity and efficiency for financial advisors. These key features set Pipedrive apart from other similar software available in the market.

Lead Tracking and Management

- Pipedrive allows financial advisors to track leads throughout the sales pipeline, ensuring no potential client is overlooked.

- Automated lead scoring helps prioritize high-value leads, saving time and increasing conversion rates.

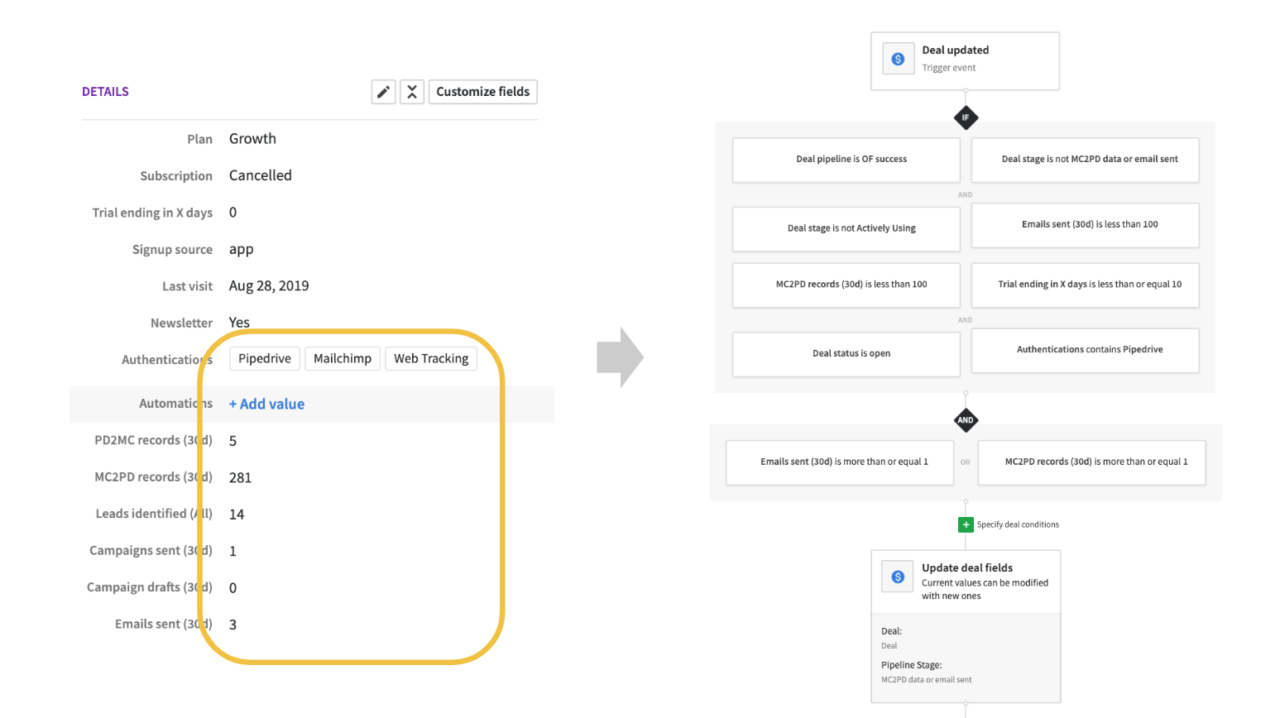

Customizable Automation

- Financial advisors can create custom automation workflows tailored to their specific needs and processes.

- Automate repetitive tasks such as email follow-ups, appointment scheduling, and document generation to streamline operations.

Integration Capabilities

- Pipedrive integrates seamlessly with other essential tools and software used by financial advisors, such as accounting software or customer relationship management systems.

- Syncing data across platforms eliminates the need for manual data entry and ensures accuracy.

Advanced Reporting and Analytics

- Generate detailed reports on sales performance, client interactions, and revenue forecasts to make informed business decisions.

- Visualize data through graphs and charts for a better understanding of trends and patterns.

Implementation of Pipedrive Automation

When it comes to implementing Pipedrive automation for financial advisory tasks, there are several best practices and considerations to keep in mind to ensure a smooth transition and effective use of the tool.One of the key best practices is to start by clearly defining your automation goals and objectives.

Identify the specific tasks and processes that you want to automate using Pipedrive and Artikel the desired outcomes

Setting Up Pipedrive Automation

- Begin by mapping out your current workflow and identifying repetitive tasks that can be automated.

- Create a detailed plan for how you want Pipedrive automation to streamline your processes.

- Utilize Pipedrive's workflow automation feature to set up triggers, actions, and conditions for different tasks.

- Test the automation sequences to ensure they are functioning correctly before full implementation.

Common Challenges Faced

- Resistance to change: Some team members may be hesitant to adopt automation tools, requiring proper training and communication.

- Data integration issues: Ensuring seamless integration between Pipedrive and existing systems can be a challenge.

- Maintaining accuracy: Monitoring and updating automation rules regularly to prevent errors or outdated information.

Integrating with Existing Systems

- Utilize Pipedrive's API to connect with other tools and systems used by financial advisors, such as accounting software or CRM platforms.

- Ensure data consistency across all integrated systems to avoid discrepancies and errors.

- Train team members on how to effectively use Pipedrive alongside existing tools for a cohesive workflow.

Customization and Personalization with Pipedrive

When it comes to financial advisors using Pipedrive automation tools, customization and personalization are key factors in enhancing client interactions and streamlining workflows.Financial advisors can customize automation workflows in Pipedrive by creating specific pipelines tailored to their unique processes. This allows them to track leads, manage deals, and prioritize tasks based on their individual needs and preferences.

Personalizing Client Interactions

Financial advisors can personalize client interactions using Pipedrive automation tools by setting up personalized email templates, scheduling automated follow-ups, and creating custom fields to capture important client information. By personalizing communication and tailoring responses to each client's needs, advisors can build stronger relationships and increase client satisfaction.Examples of successful customization strategies implemented by financial advisors using Pipedrive include creating automated reminders for important client meetings, segmenting clients based on their investment preferences, and setting up automated notifications for key milestones in the client journey.

These strategies not only save time but also ensure that each client receives a personalized and tailored experience.Overall, customization and personalization with Pipedrive automation tools empower financial advisors to deliver a more personalized and efficient service to their clients, ultimately leading to better client relationships and increased business success.

Final Summary

In conclusion, the realm of pipedrive automation tools for financial advisors presents a transformative opportunity to elevate operational efficiency, enhance client interactions, and drive business growth. By embracing these tools and their functionalities, financial advisors can embark on a path towards sustainable success in a dynamic industry landscape.

FAQ Insights

How can automation tools benefit financial advisors?

Automation tools can streamline repetitive tasks, improve efficiency, reduce errors, and enhance overall productivity for financial advisors.

What specific tasks can be automated using Pipedrive?

Pipedrive can automate lead management, email communication, task scheduling, and sales pipeline tracking for financial advisors.

What are some common challenges faced during the implementation of Pipedrive automation?

Common challenges include resistance to change, data migration issues, and the need for training staff on new processes.

How can financial advisors customize automation workflows in Pipedrive?

Financial advisors can customize workflows by creating personalized automation sequences, setting up custom fields, and defining specific triggers for actions.

Can Pipedrive automation tools be integrated with existing systems used by financial advisors?

Yes, Pipedrive offers integrations with various software applications commonly used by financial advisors, enabling seamless workflow connectivity.