Insurance Options for Historic Home Interiors: A Comprehensive Guide

Exploring the realm of Insurance Options for Historic Home Interiors, this piece delves into the intricacies and considerations surrounding insurance coverage for historical properties. From the unique features that impact insurance options to the importance of specialized coverage, this guide provides valuable insights for homeowners of historic homes.

As we navigate through the various types of insurance coverage available, preservation and restoration considerations, valuation methods, and risk management strategies, readers will gain a deeper understanding of how to protect and maintain the historical integrity of their beloved properties.

Factors to Consider for Historic Home Interiors Insurance

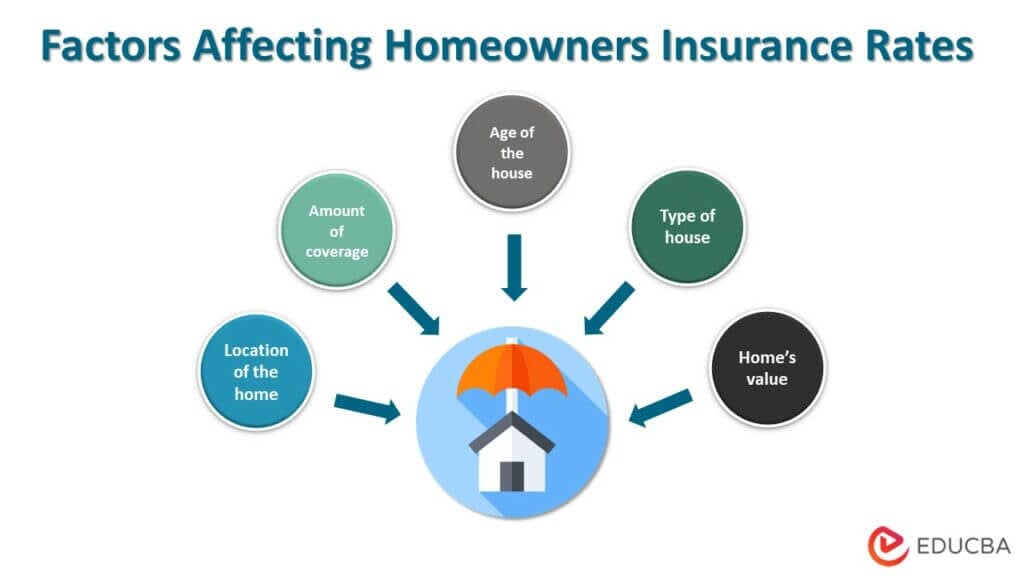

When insuring a historic home, there are several key factors to consider to ensure adequate coverage and protection for its unique features and historical elements. The age of the home, historical significance, and specialized materials used in construction all play a crucial role in determining the insurance options available.

Unique Features of Historic Homes

Historic homes often boast unique architectural features, such as ornate woodwork, stained glass windows, and intricate plaster details, that are not commonly found in modern homes. These distinctive elements require specialized coverage to ensure they are adequately protected in the event of damage or loss.

Specialized Coverage for Historical Elements

Insurance options for historic homes should include coverage for historical elements that may be difficult or costly to replace. This can include coverage for restoration or replication of original features, such as period-appropriate materials or craftsmanship, to maintain the historical integrity of the home.

Influence of Home Age on Insurance Considerations

The age of a historic home can significantly impact insurance considerations, as older homes may have outdated electrical, plumbing, or heating systems that require additional coverage. Insurers may also take into account the historical significance of the home and its location when determining coverage options and premiums.

Types of Insurance Coverage Available

When it comes to insuring historic home interiors, there are several insurance options tailored specifically for these unique properties. It's important to understand the differences between standard home insurance and specialized historic home coverage to ensure your historical property is adequately protected.

Standard Home Insurance vs. Specialized Historic Home Coverage

Standard home insurance policies typically provide coverage for the structure of the home, personal belongings, and liability protection. However, these policies may not take into account the unique characteristics and value of historic homes. On the other hand, specialized historic home coverage offers additional protection for the historical features, antique materials, and craftsmanship that make these properties special.

- Specialized Valuation: Historic home insurance may include coverage for the cost of restoring or repairing historical features that may not be covered under a standard policy.

- Increased Coverage Limits: Specialized policies often have higher coverage limits to account for the higher cost of materials and labor needed to restore historical properties.

- Reconstruction Costs: Some policies may cover the cost of rebuilding a historical home to its original condition in the event of a total loss.

Specific Policies for Historical Properties

There are insurance companies that specialize in providing coverage for historic homes, offering policies that are tailored to the unique needs of these properties. Some examples of specific policies that cater to historical properties include:

| Historic Homeowners Insurance | Provides coverage for historical features, antique materials, and craftsmanship unique to historic homes. |

| National Register of Historic Places Insurance | Offers specialized coverage for properties listed on the National Register of Historic Places, with additional protections for preservation efforts. |

| Historical Landmark Insurance | Designed for properties designated as historical landmarks, providing coverage for restoration and preservation costs. |

Preservation and Restoration Coverage

Preservation and restoration coverage are crucial aspects of insurance for historic home interiors. These types of coverage are designed to protect the historical integrity of a property and ensure that any necessary restoration work can be completed with proper financial support.

Significance of Preservation Coverage

Preservation coverage is essential for maintaining the historical features and unique characteristics of a historic home. It provides financial assistance for preserving original materials, structures, and architectural elements that contribute to the property's historical significance. Without preservation coverage, homeowners may struggle to fund the costly upkeep required to maintain the authenticity of their historic interiors.

Difference in Restoration Coverage

Restoration coverage differs from regular insurance by specifically focusing on the costs associated with restoring a historic home to its original condition in the event of damage or deterioration. This type of coverage takes into account the specialized expertise and materials often required for historical restoration projects, which may not be covered under standard insurance policies.

Assessing Coverage Needs

When determining the coverage needs for preservation and restoration, homeowners should consider the age, condition, and historical significance of their property. An assessment by a qualified appraiser or restoration specialist can help determine the potential risks and required coverage amounts.

It is essential to ensure that the insurance policy provides adequate coverage for both routine preservation efforts and major restoration projects to safeguard the historical integrity of the home.

Valuation of Historic Home Interiors

Determining the value of historical elements within a home is a crucial aspect of insuring historic properties. These unique features often require specialized valuation methods to accurately assess their worth and ensure proper insurance coverage.

Methods for Valuing Historical Elements

- Comparative Market Analysis: This method involves comparing the historic features of a home to similar properties in the market to determine their value.

- Cost Approach: Valuing historical elements based on the cost of replacing or repairing them, taking into account their age, rarity, and craftsmanship.

- Income Approach: Assessing the potential income generated by historical features, such as renting out a historic ballroom or event space within the property.

Challenges of Valuing Unique Historical Features

- Subjectivity: The value of historical elements can be subjective and vary depending on the appraiser's expertise and perspective.

- Lack of Comparable Sales: Finding comparable properties with similar historical features for accurate valuation can be challenging.

- Changing Market Trends: The value of historical elements may fluctuate over time due to changing market trends and demand for historic properties.

Role of Appraisals in Securing Insurance Coverage

- Appraisals provide a detailed assessment of the value of historical elements within a home, helping insurers determine the appropriate coverage limits.

- An accurate appraisal ensures that unique historical features are adequately insured against damage, loss, or depreciation.

- Regular appraisals can help property owners update their insurance coverage to reflect any changes in the value of historical elements over time.

Risk Management Strategies for Historic Homes

When it comes to insuring historic home interiors, minimizing risks is crucial to ensure the protection of these valuable assets. Implementing effective risk management strategies can help homeowners navigate the complexities of insuring historical properties.

Tips for Minimizing Risks

- Regular maintenance: Conducting regular inspections and maintenance can help identify potential issues early on, reducing the risk of costly damages.

- Security measures: Installing security systems, smoke detectors, and fire alarms can help prevent accidents and minimize risks.

- Proper documentation: Keeping detailed records of the property's history, renovations, and valuable items can facilitate the insurance claims process in case of an incident.

Impact of Preventive Maintenance on Insurance Premiums

Engaging in preventive maintenance practices can not only reduce the likelihood of damages but also have a positive impact on insurance premiums. Insurance providers often offer discounts to homeowners who demonstrate proactive efforts in maintaining their historic properties.

Adapting Risk Management Strategies for Historical Properties

- Specialized coverage: Consider obtaining specialized insurance coverage tailored to the unique needs of historical properties, such as preservation and restoration coverage.

- Risk assessment: Conduct a thorough risk assessment of the property to identify vulnerabilities and implement targeted risk management strategies.

- Consult experts: Seek guidance from insurance professionals with experience in insuring historic homes to ensure comprehensive coverage and effective risk management.

Final Review

In conclusion, Insurance Options for Historic Home Interiors is a crucial aspect of preserving the rich heritage and unique characteristics of historical properties. By understanding the nuances of insurance coverage tailored for historic homes, homeowners can ensure the protection and longevity of these architectural treasures for generations to come.

Questions Often Asked

What factors should be considered when insuring historic home interiors?

Factors to consider include the unique features of historic homes, the need for specialized coverage, and how the age of the home influences insurance considerations.

How does preservation coverage differ from regular insurance for historic homes?

Preservation coverage is specifically tailored to maintain historical integrity, whereas regular insurance may not adequately protect unique historical elements.

What are some risk management strategies for historic homes?

Tips include minimizing risks associated with insuring historic properties, the impact of preventive maintenance on insurance premiums, and adapting strategies to suit the needs of historical properties.