Affordable CRM Options for Independent Advisors: A Comprehensive Guide

Exploring the realm of affordable CRM options for independent advisors opens up a world of possibilities. From essential features to integration tips, this guide will navigate you through the landscape of CRM solutions tailored for independent advisors.

As we delve deeper, you'll uncover insights on customization, user-friendly interfaces, and the crucial support and training services that can elevate your CRM experience. Get ready to revolutionize your advisory business with cost-effective CRM solutions!

Researching CRM Options

When researching CRM options for independent advisors, it is essential to consider key features that can enhance efficiency and productivity in managing client relationships. Additionally, scalability is crucial to accommodate growth and changing needs over time. Pricing structures vary among different CRM options, so it is important to compare them to find the most suitable solution for your independent advisory practice.

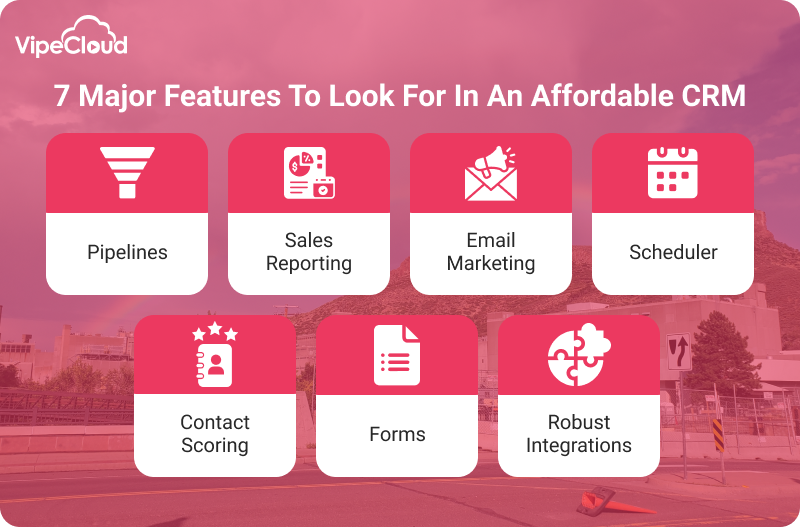

Key Features to Look For

- Customizable Dashboards: Allows you to tailor the interface to display the most relevant information for your workflow.

- Integration Capabilities: Seamless integration with other tools and platforms you use for a more cohesive workflow.

- Automation Features: Streamline repetitive tasks such as email follow-ups, scheduling appointments, and data entry.

- Reporting and Analytics: Access to insights and performance metrics to make informed decisions and track progress.

- Mobile Accessibility: Ability to access and update client information on-the-go for flexibility and convenience.

Importance of Scalability

Scalability is crucial for independent advisors as their business grows and evolves. A CRM system that can scale with your practice ensures that you can continue to effectively manage client relationships, even as your client base expands. It also allows for the addition of new features and functionalities to meet changing needs over time.

Comparing Pricing Structures

| CRM Option | Pricing Structure |

|---|---|

| CRM A | Monthly subscription based on number of users and features included. |

| CRM B | One-time purchase with additional fees for upgrades and support. |

| CRM C | Free basic version with premium features available as add-ons for a fee. |

Customization and Integration

Customizable CRM solutions offer a range of benefits for independent advisors, allowing them to tailor the system to their specific needs and preferences. This flexibility enables advisors to optimize their workflows, improve client relationships, and enhance overall efficiency.

Essential Integrations for CRM Systems

Integrating CRM systems with other tools commonly used by independent advisors is essential for streamlining processes and maximizing productivity. Some key integrations include:

- Financial Planning Software: Integration with financial planning software allows advisors to access comprehensive client financial data in one place, facilitating more informed decision-making and personalized recommendations.

- Email Marketing Platforms: Integrating CRM with email marketing tools enables advisors to create targeted campaigns, track interactions, and analyze client engagement for more effective communication strategies.

- Calendar and Scheduling Apps: Syncing CRM with calendar apps helps advisors manage appointments, set reminders, and ensure timely follow-ups with clients, enhancing organization and time management.

Process of Integrating CRM Systems

Integrating a CRM system with existing tools involves a systematic approach to ensure a seamless transition and optimal performance. The process typically includes:

- Assessment: Identify the tools and systems currently in use and evaluate compatibility with the CRM solution to determine integration requirements.

- Configuration: Customize the CRM system settings to align with the needs of the advisor and establish data mapping for smooth data transfer between platforms.

- Testing: Conduct thorough testing to validate integration functionality, ensure data accuracy, and address any issues or discrepancies before full implementation.

- Training: Provide training sessions for advisors and staff to familiarize them with the integrated system, optimize usage, and troubleshoot any potential challenges.

User-Friendly Interface

Creating an interface that is intuitive and easy to navigate is crucial for independent advisors using CRM systems. A user-friendly interface can enhance productivity, streamline workflows, and ultimately improve client relationships. Let's delve into the significance of a user-friendly interface in CRM systems for independent advisors and compare the ease of use of different affordable CRM options available to them.

Importance of User-Friendly Interface

A user-friendly interface simplifies the process of accessing and inputting data, allowing advisors to focus on their core tasks without getting bogged down by complex navigation. It reduces the learning curve for new users, increases efficiency, and minimizes errors. A well-designed interface can also boost user adoption rates and overall satisfaction with the CRM system.

Comparison of Affordable CRM Options

When evaluating affordable CRM options, independent advisors should consider the ease of use of each platform. Some CRM systems offer customizable dashboards, drag-and-drop functionality, and intuitive workflows that make it easy for advisors to organize client information, track interactions, and manage tasks.

It is essential to choose a CRM system that aligns with the specific needs and preferences of the advisor to ensure a seamless user experience.

Tips for Evaluating User Interface

- Look for a clean and uncluttered interface that is easy to navigate.

- Consider the customization options available to tailor the interface to your workflow.

- Test the mobile compatibility of the CRM system to ensure accessibility on-the-go.

- Pay attention to the organization of information and the ability to search and filter data efficiently.

- Seek feedback from other users or request a demo to experience the interface firsthand before making a decision.

Support and Training

When it comes to affordable CRM options for independent advisors, the support and training provided by CRM vendors play a crucial role in ensuring successful implementation and utilization of the system.

Types of Support Services

Independent advisors should expect the following types of support services from affordable CRM providers:

- 24/7 customer support: Access to round-the-clock assistance for any technical issues or queries.

- Online resources: Providing a knowledge base, tutorials, and FAQs for self-help and troubleshooting.

- Regular updates and maintenance: Ensuring the CRM system is up to date and running smoothly.

- Personalized support: Offering tailored assistance based on the specific needs and requirements of the advisor.

Importance of Training Resources

Training resources offered by CRM vendors are essential for independent advisors to fully leverage the capabilities of the system:

- Onboarding training: Initial training sessions to help advisors get familiar with the CRM platform.

- Advanced training: Providing in-depth training for utilizing advanced features and functionalities of the CRM.

- Ongoing training: Offering continuous training sessions to keep advisors updated on new features and best practices.

Best Practices for Leveraging Support and Training Resources

Here are some best practices for independent advisors to make the most out of the support and training resources provided by CRM companies:

- Attend training sessions: Make sure to participate in all training sessions offered to gain a comprehensive understanding of the CRM system.

- Utilize online resources: Take advantage of the knowledge base and tutorials provided by the CRM vendor for quick solutions to common issues.

- Communicate with support: Don't hesitate to reach out to customer support whenever you encounter challenges or need assistance with the CRM platform.

- Provide feedback: Share your feedback with the CRM vendor to help improve their support and training resources for better user experience.

Final Thoughts

In conclusion, the realm of affordable CRM options for independent advisors is vast and full of potential. By leveraging the right tools and strategies, advisors can streamline their operations, enhance client relationships, and achieve greater success in their practice. Embrace the power of affordable CRM solutions and take your advisory business to new heights!

Clarifying Questions

What key features should independent advisors look for in CRM systems?

Independent advisors should prioritize features like robust contact management, task automation, and reporting capabilities to effectively manage client relationships.

Why is scalability important when selecting a CRM for independent advisors?

Scalability ensures that the CRM system can grow with the advisor's business, accommodating an increasing client base and evolving needs without major disruptions.

What are some essential integrations for CRM systems used by independent advisors?

Common integrations include email marketing platforms, financial planning tools, and document management systems to enhance productivity and streamline workflows.

How significant is a user-friendly interface in CRM systems for independent advisors?

A user-friendly interface is crucial for efficient use of the CRM system, enabling advisors to navigate smoothly, access information quickly, and maximize productivity.

What types of support services should independent advisors expect from affordable CRM providers?

Independent advisors should look for providers offering responsive customer support, training resources, and regular updates to ensure optimal use of the CRM platform.