Crafting Effective CRM Strategies with Email Automation for Financial Services

In the dynamic world of financial services, the fusion of CRM with email automation emerges as a game-changer. This innovative approach not only enhances efficiency but also revolutionizes client interactions. Let's delve deeper into the realm of CRM with email automation for financial services.

Overview of CRM with Email Automation for Financial Services

CRM (Customer Relationship Management) with email automation is a powerful tool used in the financial services industry to effectively manage client relationships and improve communication through automated email campaigns. By integrating CRM software with email automation, financial institutions can streamline processes, enhance customer engagement, and drive business growth.

Benefits of Integrating CRM and Email Automation for Financial Institutions

- Improved Customer Engagement: CRM with email automation allows financial institutions to send personalized and timely emails to clients, increasing engagement and building stronger relationships.

- Efficient Communication: Automated emails can be scheduled to deliver important information, updates, and reminders to clients, saving time and ensuring consistent communication.

- Lead Nurturing: CRM software can track client interactions and behaviors, allowing financial institutions to nurture leads through targeted email campaigns based on client preferences and actions.

- Increased Sales and Conversions: By sending relevant and targeted emails to clients, financial institutions can drive sales and conversions, ultimately boosting revenue and growth.

Examples of How CRM with Email Automation Can Streamline Processes in the Financial Sector

- Onboarding Process: Automated emails can be used to guide new clients through the onboarding process, providing them with important information and resources to get started with financial services.

- Appointment Reminders: CRM software can automate appointment reminders for clients, reducing no-shows and ensuring a smooth scheduling process for both clients and financial advisors.

- Customer Feedback: Automated surveys and feedback requests can be sent to clients through email, allowing financial institutions to gather valuable insights and improve customer satisfaction.

- Product Updates and News: CRM with email automation can be used to inform clients about new products, services, and industry news, keeping them informed and engaged with the financial institution.

Importance of CRM in Financial Services

CRM (Customer Relationship Management) plays a crucial role in the financial services industry by helping institutions effectively manage client relationships, improve customer retention, and drive acquisition efforts. By utilizing CRM systems, financial institutions can streamline their operations, personalize customer interactions, and ultimately enhance their overall business performance.

Role of CRM in Managing Client Relationships

CRM systems in financial services enable institutions to centralize customer data, track interactions, and analyze customer behavior. This allows for a deeper understanding of individual customer needs and preferences, leading to more personalized services and tailored financial solutions.

Customer Retention and Acquisition

- CRM systems help financial institutions retain customers by identifying at-risk clients, providing proactive customer service, and offering targeted promotions or incentives.

- For customer acquisition, CRM systems enable institutions to segment their target market, identify potential leads, and nurture relationships through personalized communication and follow-ups.

- By leveraging CRM tools, financial institutions can build trust, enhance customer loyalty, and drive revenue growth through effective customer retention and acquisition strategies.

Key Features of CRM for Financial Services

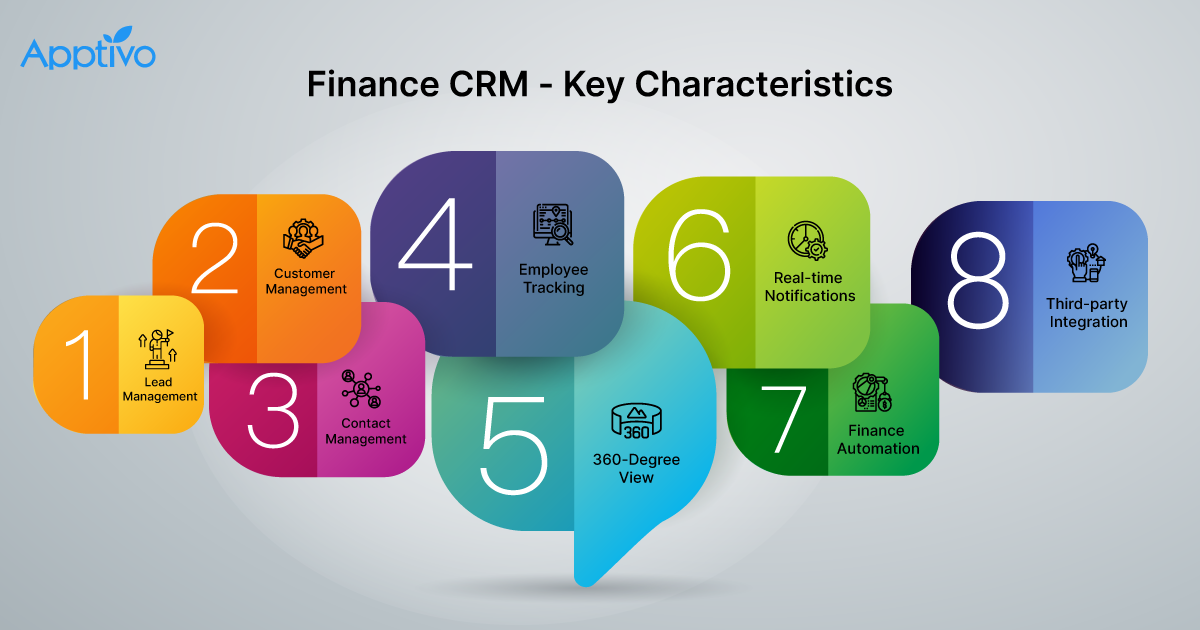

Some key features of CRM tailored for the financial services industry include:

- Integration with financial systems for seamless data exchange and analysis.

- Compliance management tools to ensure regulatory requirements are met.

- Lead scoring and tracking capabilities to prioritize sales opportunities.

- Automated workflows for efficient customer communication and follow-up processes.

- Performance analytics to measure the effectiveness of customer relationship management strategies.

Email Automation for Financial Services

Email automation plays a crucial role in the financial sector by streamlining communication processes and enhancing client engagement. Automated emails can be personalized, timely, and relevant, resulting in improved client relationships and increased efficiency for financial service providers.

Significance of Email Automation in Financial Services

Automated emails in financial services help in delivering important updates, reminders, and personalized messages to clients in a timely manner

Improving Communication with Clients

Automated emails can be used to nurture client relationships by sending personalized messages based on client interactions and behaviors. For example, sending automated birthday greetings, account balance notifications, or investment performance updates can help in strengthening client trust and loyalty.

Additionally, automated emails can be utilized to provide educational content, promote new services or products, and gather feedback from clients.

Effective Automated Email Campaigns in Financial Services

1. Onboarding Emails

Welcome new clients with a series of automated emails introducing them to the services offered, providing important information, and guiding them through the onboarding process.

2. Transactional Emails

Send automated transactional emails for account updates, payment confirmations, and security alerts to keep clients informed and engaged.

3. Personalized Recommendations

Utilize automated emails to suggest personalized financial products or services based on client preferences, behaviors, and financial goals.

4. Event Reminders

Send automated reminders for upcoming financial events, webinars, or seminars to ensure client participation and engagement.

5. Feedback Surveys

Use automated emails to gather feedback from clients regarding their satisfaction with services, overall experience, and suggestions for improvement.

Integration of CRM and Email Automation

Integrating CRM (Customer Relationship Management) and email automation tools can provide numerous advantages for financial services. This combination enhances customer engagement and satisfaction by allowing for personalized communication and timely follow-ups.

Advantages of Integration

- Improved Customer Communication: By combining CRM data with email automation, financial institutions can send targeted and relevant messages to customers, increasing the likelihood of engagement.

- Efficient Follow-Ups: Automated emails triggered by CRM data can ensure that customers receive timely responses and updates, leading to better customer satisfaction.

- Enhanced Customer Insights: Integration of CRM and email automation allows for tracking customer interactions and preferences, enabling financial institutions to tailor their services accordingly.

Best Practices for Seamless Integration

- Choose Compatible Tools: Select CRM and email automation platforms that are easily integrated and work well together to avoid technical issues.

- Define Workflows: Establish clear workflows for how CRM data will trigger automated email campaigns, ensuring a cohesive and efficient process.

- Segment Customer Data: Utilize CRM data to segment customers based on demographics, behavior, or preferences for more personalized and targeted email campaigns.

- Monitor Performance: Regularly review the performance of integrated CRM and email automation efforts to optimize strategies and improve results.

Closing Summary

As we conclude our exploration of CRM with email automation for financial services, it becomes evident that this integration is pivotal for modern financial institutions. By leveraging technology to nurture client relationships, organizations can pave the way for sustained growth and success.

FAQ Overview

How can CRM with email automation benefit financial institutions?

CRM with email automation can streamline communication processes, enhance customer engagement, and improve overall efficiency for financial institutions.

What are some key features of CRM tailored for the financial services industry?

Key features include client data management, automated workflow processes, personalized communication tools, and analytics for informed decision-making.

How does email automation improve communication with clients in financial services?

Email automation allows for timely and personalized communication, ensuring that clients receive relevant information and updates efficiently.