Understanding Insurance Deductibles for Interior Repairs: A Comprehensive Guide

Understanding Insurance Deductibles for Interior Repairs sheds light on a crucial aspect of insurance coverage that many overlook. Dive into this informative piece to unravel the intricacies of deductibles for interior repairs, presented in a captivating manner with a casual formal language style.

Delve deeper into the nuances of insurance deductibles for interior repairs in the following sections, exploring key concepts and practical tips to navigate this often misunderstood terrain.

Understanding Insurance Deductibles for Interior Repairs

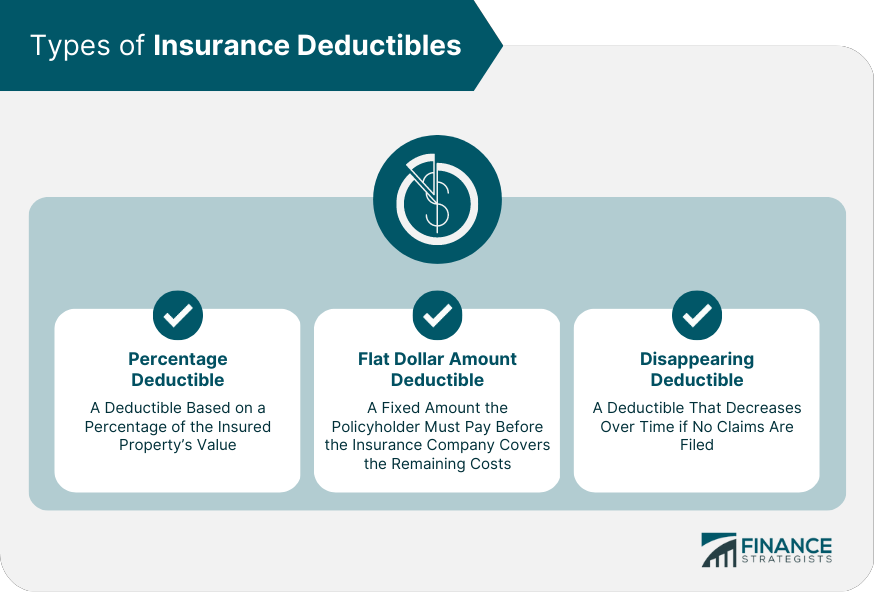

When it comes to insurance deductibles for interior repairs, it is essential to have a clear understanding of how they work and what factors can influence the deductible amount. Insurance deductibles are the out-of-pocket amount that the policyholder is responsible for paying before the insurance company covers the remaining cost of the claim.

Examples of Common Scenarios

- Water damage from a burst pipe in the kitchen.

- Fire damage in the living room.

- Mold remediation in the basement.

In these scenarios, the policyholder would need to pay the deductible amount before the insurance coverage kicks in to help with the repair costs.

Factors Influencing Deductible Amount

- Type of policy and coverage limits.

- Location and severity of the damage.

- Premium costs and chosen deductible amount.

These factors can impact how much the deductible will be for interior repairs and should be considered when selecting an appropriate deductible for your policy.

Tips for Determining Appropriate Deductibles

- Evaluate your financial situation and ability to cover the deductible.

- Consider the likelihood of filing a claim for interior repairs.

- Compare premium costs for different deductible amounts.

By assessing these factors, you can make an informed decision on the deductible amount that aligns with your needs and budget for interior repair coverage.

Types of Interior Damage Covered by Insurance

When it comes to interior damage covered by insurance, there are several common types that policyholders should be aware of. Understanding what is covered can help you navigate the claims process more effectively and ensure you receive the appropriate compensation for repairs.

Water Damage

- Water damage is a common issue that can result from burst pipes, plumbing leaks, or natural disasters like floods.

- Insurance policies typically cover water damage caused by sudden and accidental events, but gradual damage may not be covered.

- It's important to review your policy to understand coverage limits and exclusions related to water damage.

Fire Damage

- Fire damage can devastate a home, leading to the need for extensive repairs and restoration.

- Most insurance policies cover fire damage, including the cost of rebuilding or repairing the interior of your home.

- Make sure to document the extent of the damage and keep receipts for any temporary housing or living expenses incurred due to the fire.

Structural Damage

- Structural damage refers to issues with the foundation, walls, or roof of a home that can compromise its integrity.

- Insurance coverage for structural damage may vary depending on the cause of the damage, such as a natural disaster or wear and tear.

- It's essential to assess the extent of the structural damage accurately when filing a claim to ensure you receive the appropriate compensation.

Assessing Interior Damage

- When assessing interior damage for an insurance claim, document the extent of the damage with photographs or videos.

- Obtain estimates from reputable contractors to provide a detailed breakdown of repair costs.

- Review your policy to understand coverage limits, deductibles, and any additional living expenses that may be reimbursed during repairs.

Cost Considerations and Budgeting for Interior Repairs

When dealing with interior repairs, understanding the cost factors involved is crucial for effective budgeting. Let's explore the key considerations to keep in mind.

Cost Factors Impacting Insurance Deductibles

- Extent of Damage: The severity of interior damage, whether it's from water, fire, or other causes, directly impacts repair costs and deductible amounts.

- Materials and Labor Costs: The type of materials needed for repairs and the labor rates of contractors play a significant role in determining overall costs.

- Additional Services: Any additional services required, such as mold remediation or structural repairs, can add to the total expenses.

Budgeting and Cost Management Strategies

- Get Multiple Quotes: Obtain detailed repair estimates from different contractors to compare prices and negotiate for better deals.

- Discuss Payment Plans: Inquire about flexible payment options or financing arrangements to manage costs within your budget constraints.

- DIY Options: Consider tackling minor repairs yourself to save on labor costs, but ensure you have the necessary skills and tools.

Negotiating Repair Estimates and Insurance Adjusters

- Provide Documentation: Present thorough documentation of the damage and repair estimates to support your negotiations with insurance adjusters.

- Ask Questions: Don't hesitate to ask for clarification on the scope of work, costs, and coverage details to ensure you understand the insurance claim process.

- Be Flexible: Be open to discussing alternatives with contractors and adjusters to find cost-effective solutions that meet your needs.

Prioritizing Repairs Based on Budget Constraints

- Focus on Essentials: Identify critical repairs that impact safety and structural integrity first, then prioritize cosmetic enhancements based on available funds.

- Maximize Coverage: Opt for repairs that are covered by insurance to minimize out-of-pocket expenses and make the most of your policy benefits.

- Phased Approach: If budget limitations are significant, consider dividing repairs into phases and addressing high-priority areas first before moving on to others.

Process of Filing an Insurance Claim for Interior Repairs

When it comes to filing an insurance claim for interior repairs, it's essential to follow a step-by-step process to ensure a smooth and successful outcome. This involves gathering the necessary documentation, understanding the coverage provided by your insurance policy, and avoiding common pitfalls that could delay or jeopardize your claim.

Documentation Required for an Interior Repair Insurance Claim

- Provide photos or videos of the interior damage as soon as possible to document the extent of the harm.

- Keep receipts and invoices for any repairs or replacements needed, as these will serve as proof of expenses.

- Have a copy of your insurance policy on hand to reference coverage details and exclusions.

- If applicable, obtain estimates from contractors or professionals for the repair work needed.

Common Pitfalls to Avoid When Filing an Insurance Claim for Interior Damage

- Avoid delaying the claim process, as prompt action can prevent further damage and increase the chances of approval.

- Do not underestimate the extent of the damage or omit any details when reporting the incident to your insurance company.

- Be cautious of reaching a settlement too quickly without fully assessing the scope of repairs required.

- Avoid making repairs before getting approval from your insurance provider, as this could impact your claim eligibility.

Tips for Expediting the Claims Process and Maximizing Insurance Coverage

- Stay organized by keeping all relevant documents and communication related to the claim in one place for easy reference.

- Respond promptly to any requests or inquiries from your insurance company to avoid delays in processing your claim.

- Consider hiring a public adjuster to help navigate the claims process and negotiate with the insurance company on your behalf.

- Review your insurance policy regularly to understand your coverage and ensure you are maximizing your benefits for interior repairs.

Closure

As we wrap up our exploration of Understanding Insurance Deductibles for Interior Repairs, you're now equipped with valuable insights to make informed decisions regarding your insurance coverage. Remember, knowledge is power when it comes to protecting your home and belongings.

Detailed FAQs

What factors can influence the deductible amount for interior repairs?

The deductible amount for interior repairs can be influenced by factors such as the type of damage, the location of the property, and the policyholder's claims history.

How can I determine the appropriate deductible for interior repair coverage?

To determine the appropriate deductible for interior repair coverage, consider your budget, the likelihood of needing repairs, and the potential savings on your insurance premium.

What are some common types of interior damage covered by insurance policies?

Common types of interior damage covered by insurance policies include water damage, fire damage, mold damage, and vandalism.

What documentation is usually required to support an interior repair insurance claim?

Documentation such as repair estimates, photographs of the damage, receipts for repairs, and any communication with insurance adjusters are typically required to support an interior repair insurance claim.